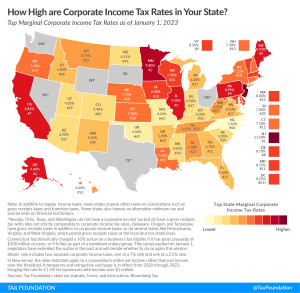

Tax Brackets 2024 Arizona Individual

Tax Brackets 2024 Arizona Individual – If you fall into a lower tax bracket this year, you might see an increase in your take-home pay. Courtney Johnston is a senior editor leading the CNET Money team. Passionate about financial literacy . The IRS reviews all income tax brackets annually, making adjustments as necessary to balance for inflation. For the 2024 tax year, tax rates range from 10% at the low end to a top rate of 37%. These .

Tax Brackets 2024 Arizona Individual

Source : taxfoundation.org

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

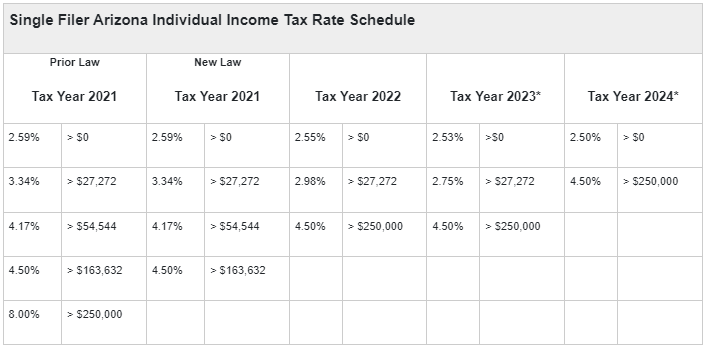

Arizona enacts several new tax measures Lexology

Source : www.lexology.com

New IRS tax brackets take effect in 2024, meaning your paycheck

Source : www.fox10phoenix.com

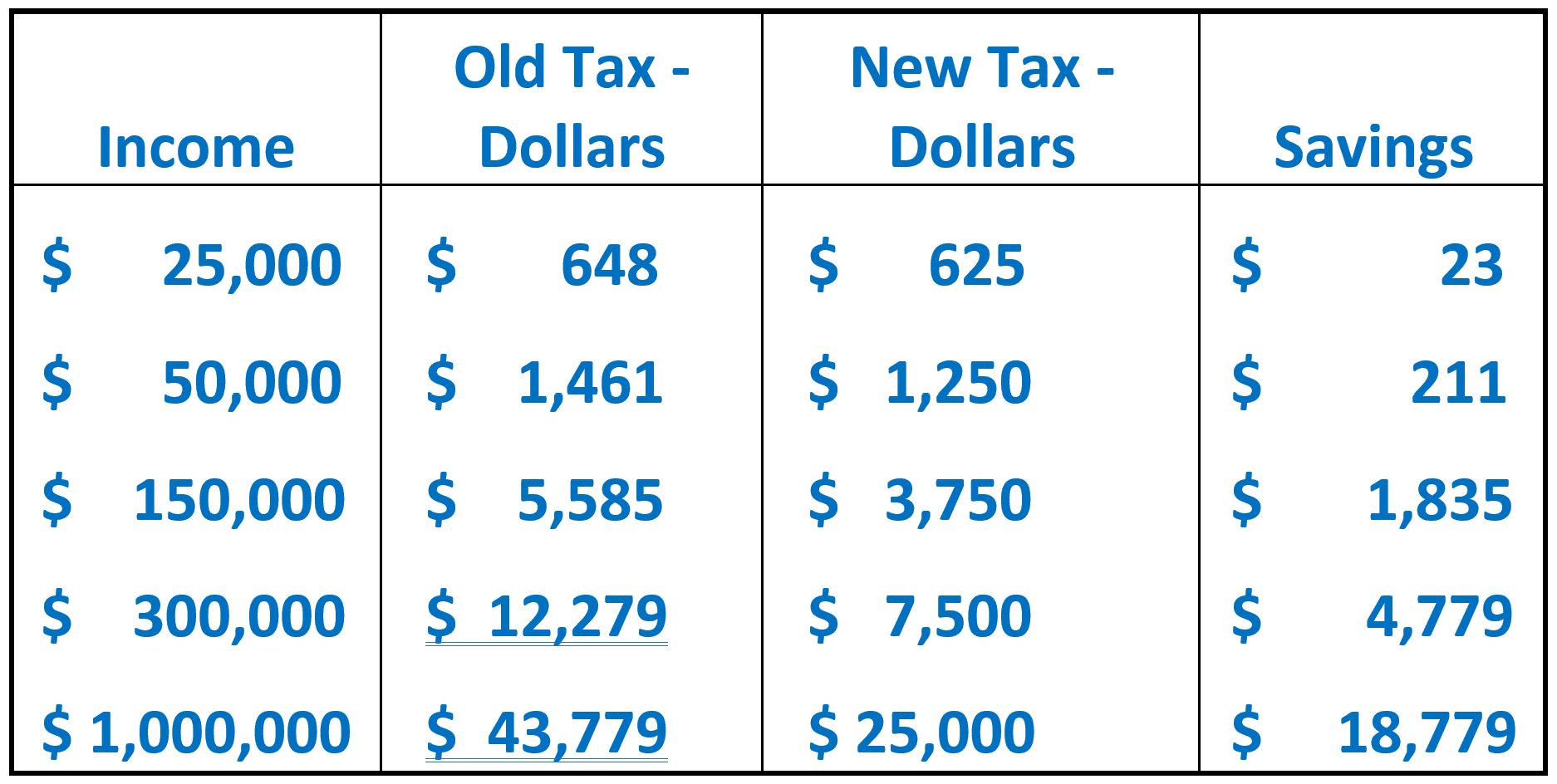

What is Arizona’s new flat tax and what does it mean for you

Source : news.nau.edu

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

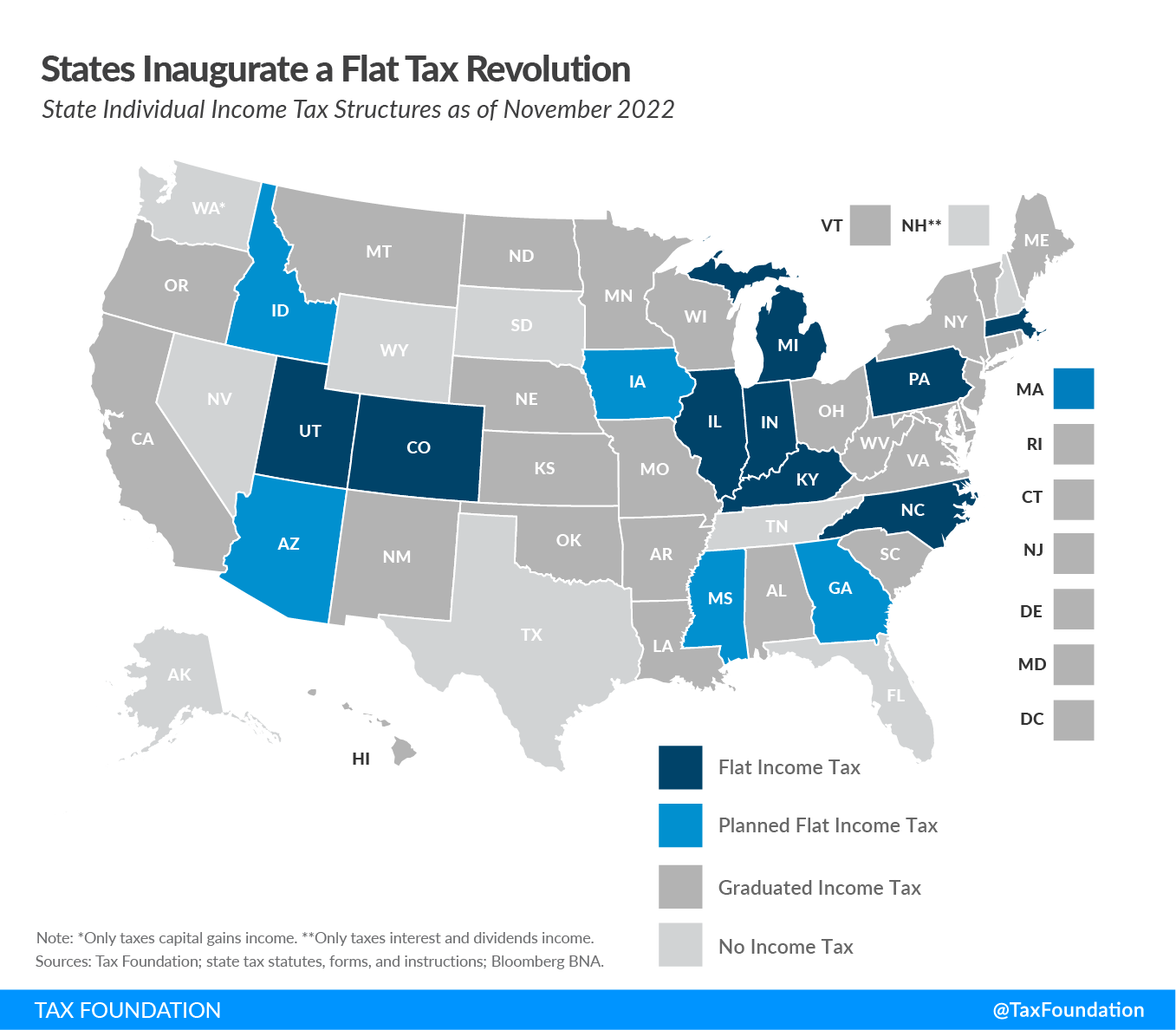

Flat Tax Revolution: State Income Tax Reform | Tax Foundation

Source : taxfoundation.org

Arizona Tax Rates & Rankings | Arizona State Taxes

Source : taxfoundation.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

State Income Tax Rates and Brackets, 2022 | Tax Foundation

Source : taxfoundation.org

Tax Brackets 2024 Arizona Individual 2023 State Income Tax Rates and Brackets | Tax Foundation: For 2024, the lowest rate of 10% will apply to individual with taxable income up to $11,600 and joint filers up to $23,200. The top rate of 37% will apply to individuals making above $609,350 and . The Internal Revenue Service has no right to force 750,000 Arizona families who got a state income back off depends on how much they earn. There are seven tax brackets, ranging from 10% for .